Investing in funds

With your long-term goals in sight, diversifying your portfolio with funds can be a reliable investment strategy to spread your money and risk across different investments in a single trade. Choose from 1,400+ different investment products, such as Mutual Funds, Exchange-Traded Funds (ETFs), Investment Trusts, and Real Estate Investment Trusts (REITs).

When you invest, your capital is at risk.

What we offer

As investors, we understand the importance of bringing balance to your portfolio and how high dealing fees can impact its long-term performance. To help, we're committed to offering commission-free trades, competitive fees, and innovative features. Have a look at our price plans for information.

£0 commission

Have more cash to put towards your investments by saving money on commission on every trade. Other charges apply.

Flat-rate fees

With our flat-rate platform fees, you’ll know exactly how much you’re paying each month. See our price plans for more information.

FX fees

For every international asset you buy or sell, we’ll always offer an FX fee of 0.50%.

Live pricing

See the value of your portfolio in real-time and get pricing up-to-the-second on investments you buy, sell, or hold.

Do you have more questions about funds? Check out our FAQs

What you can invest in

Explore and choose from our curated list of ETFs, Investment Trusts and REITs.

Note: Our table shows the top 10 most popular funds in the platform based on trading volume for the last 30 days.

When you invest, your capital is at risk. Past performance isn’t a reliable guide to future results.

| Name | Symbol | Price* | Price Movement |

|---|

| Name | Symbol | Price* | Price Movement |

|---|

*15-minutes price delay.

Looking for something specific?

Use our dropdown selector above to help you find the information that matters to you the most.

Our benefits

ESG ratings & preferences

- You can pick investments that align with your core values. You can also predefine your ESG preferences and be alerted when an asset does or doesn’t match these options.

USD & EUR wallets

Save money on FX fees with our currency wallets. Convert cash once then hold it in USD or EUR for future investments. Learn more about our USD and EUR wallets. This feature can only be used in our GIA.

Bull vs Bear insights

- Get a well-rounded outlook from a bullish (positive) and a bearish (pessimistic) financial analyst, so you can determine whether a company is the right investment for you.

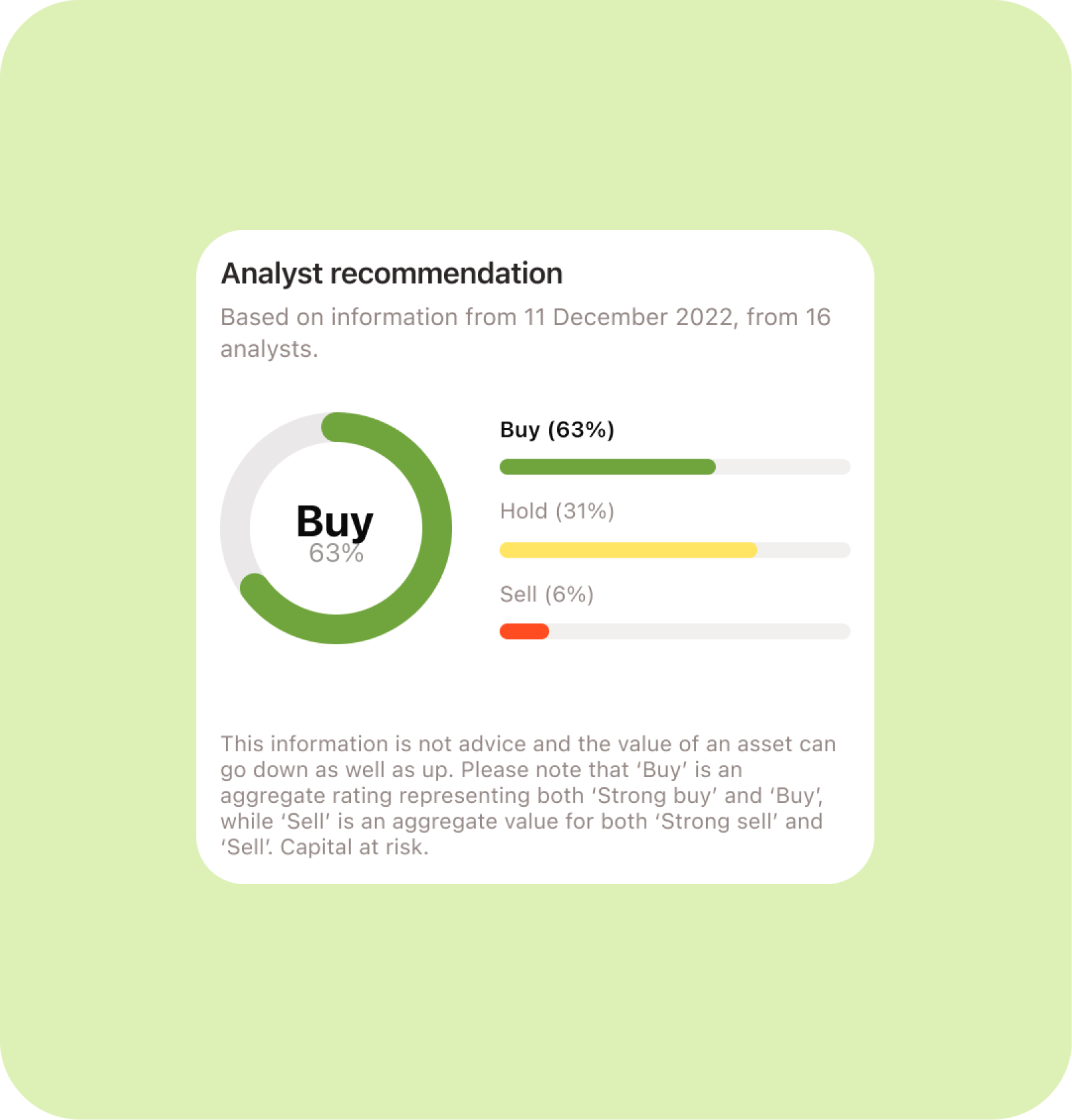

Analyst ratings

- This is the view from a group of professional financial analysts on whether they think a share should be bought, sold, or held.

Company fundamental analysis

- See detailed information about a company which includes valuation ratios, market capitalisation, growth ratios, cash flow and income.

Straightforward and transparent price plans

Browse and choose from one of our plans that suits what you need. No hidden fees, no nasty surprises, just straightforward and transparent pricing. FX fees and UK government charges may apply.

Core

Plus

Premium

Core plan

£0

Always pay nothing for our Core plan. Our Core plan will always be £0/month.

Accounts

- Easy access Cash ISA

- General Investment Account

- Flexible Stocks & Shares ISA

- Self-invested Personal Pension

Benefits

- £0 Commission

- 3,000+ US shares

- Large-cap UK shares

- 400+ ETFs and Investment Trusts

- 2% interest on cash balances

OFFER

Plus plan

£10 £0

Get our Plus plan for £0/month for the first 3 months* then pay up to £10/month.

Accounts

- Easy access Cash ISA

- General Investment Account

- Flexible Stocks & Shares ISA

- Self-invested Personal Pension

Benefits

- Everything in Core

- 1,000+ Mutual Funds

- Mid & Small-cap UK shares

- AIM shares

- USD & EUR wallets (GIA only)

OFFER

Premium plan

£25 £0

Get our Premium plan for £0/month for 12 months^, then pay up to £25/month.

Accounts

- Easy access Cash ISA

- General Investment Account

- Flexible Stocks & Shares ISA

- Self-invested Personal Pension

Benefits

- Everything in Core and Plus

When you invest, your capital is at risk.

*Plus plan 3-month free promotion terms and conditions.

^Premium plan 12-month free promotion terms and conditions.

For the full list of platform benefits, compare our price plans.

Investments can rise and fall in value. When you invest, your capital is at risk.

Learn hub

Start your investing journey with insightful how-to's , everyday money tips, and trending topics.

Find out moreTransfer to us

Combine and manage existing pensions, ISAs, and GIAs with our simple in-app transfer process. Start a transfer request with our easy-to-follow steps.

Find out moreOur SIPP account

With our Premium plan, invest towards your retirement with our tax-efficient, flat-fee, SIPP account (in partnership with Quai Investment Services Ltd).

Find out moreFrequently asked questions

What is a Mutual Fund?

Mutual funds are an investment that pools your money together with money from many other investors. Fund managers then invest the money in a wide range of investments, depending on the mutual fund’s objective, investment strategy, and policy.

What is an ETF?

ETF stands for exchange-traded fund. An ETF is a type of fund that holds a basket of underlying investments, with the aim of tracking a particular index, stock market or commodity, such as the FTSE 100, S&P 500 or physical gold.

ETFs can be bought and sold on a stock exchange, just like listed company shares, and because they include multiple assets, they provide a more diversified way to invest than buying shares in a single company.

What is an Investment Trust?

Investment trusts are a type of fund set up as a public limited company (PLC), meaning their shares can be bought and sold in the exact same way as a company’s share. Investment trusts have fund managers who invest in various assets, like property, bonds or company shares, depending on their objective and strategy.

Can I buy and sell Mutual Funds the same as ETFs?

Using the CMC Invest app you can place the buy and sell order for a Mutual Fund whenever you want, at any time. However, Mutual Funds are priced once a day and the dealing in Mutual Funds are different to ETFs. For more information read our article here.

What’s the difference between an ETF and an Investment Trust?

Both options offer a simple way to diversify. But, while an ETF tracks the performance of a stock index, region, trend, or theme, the performance of an Investment Trust is based on how the portfolio of assets and its investment strategy are managed.

Will I be charged for investing in ETFs and Investment Trusts?

We don’t charge commission per trade for investments in ETFs or investment trusts, as with all investments available through our app. The funds themselves usually have their own management fees and you can find details about these in the key information document (KID) or the key investor information document (KIID). You’ll find a link to view the KID or KIID on the asset screen, and again on the order review screen. The fund manager will deduct these fees from the assets within the fund and you can find details of these fees in the ‘Annual Cost Disclosure’, provided to you after each tax year.

When investing in ETFs, UK stamp duty and the PTM levy don’t apply. However, UK stamp duty (0.5% on buy orders) and PTM levy (£1 charge for trade values greater than £10,000) will apply for investment trusts.

If a currency conversion is required for your trade, then the standard 0.5% additional spread will be applied to the exchange rate.

Are there fees for investing in Mutual Funds?

Mutual Funds are available with our Plus and Premium plans. We don’t charge commission for individual deals in mutual funds, as with all investments available through our app.

The mutual funds themselves usually have their own management fees and you can find details about these in the key information document (KID) or the key investor information document (KIID). Links to these can be found when viewing a particular mutual fund, and again on the order review screen. The fund manager will deduct these fees from the assets within the fund and you can find details of these fees in the ‘Annual Cost Disclosure’, provided to you after each tax year. In rare cases, mutual funds also have an entry fee, exit fee or performance fee. You can find full details of these charges in the KID or KIID.

UK stamp duty and PTM levy don’t apply to mutual funds.

What's the difference between active and passive management?

Actively managed mutual funds are run by a fund manager and team of analysts. They choose the fund’s investments, making changes as needed to keep the fund performing as well as possible. These funds aim to outperform broader markets and other competing funds, although there are no guarantees.

Passively managed mutual funds, also known as 'tracker funds', take a different approach. Rather than trying to do better than the market, they track an index representing it, so their performance is tied to the ups and downs of the market they're following. Both types have their advantages. With no active manager or analysts to pay for, passive funds usually have lower fees, but there’s also little potential for outperforming the market.

How to set up and manage price alerts?

1. Find a company or fund that you want to set up an alert for

2. Tap the bell icon at the top right

3. Enter a price

4. Tap ‘Confirm’ to create price alert

You’ll need push notifications enabled for you to receive price alerts.

To manage your price alerts, tap the bell icon on the top right when viewing a stock or fund with an alert set up. From here, you’ll have two options, you can either create a new price alert or tap the delete icon next to an existing price alert.